Expert Assistance: Bagley Risk Management Techniques

Expert Assistance: Bagley Risk Management Techniques

Blog Article

Just How Livestock Threat Defense (LRP) Insurance Can Safeguard Your Livestock Investment

In the realm of animals financial investments, mitigating threats is critical to making sure financial security and development. Animals Threat Protection (LRP) insurance policy stands as a reliable guard against the unpredictable nature of the market, offering a tactical strategy to securing your possessions. By diving into the intricacies of LRP insurance and its multifaceted advantages, animals producers can strengthen their investments with a layer of protection that transcends market fluctuations. As we explore the world of LRP insurance coverage, its role in safeguarding animals financial investments comes to be significantly evident, assuring a course in the direction of sustainable financial durability in a volatile sector.

Comprehending Animals Threat Defense (LRP) Insurance

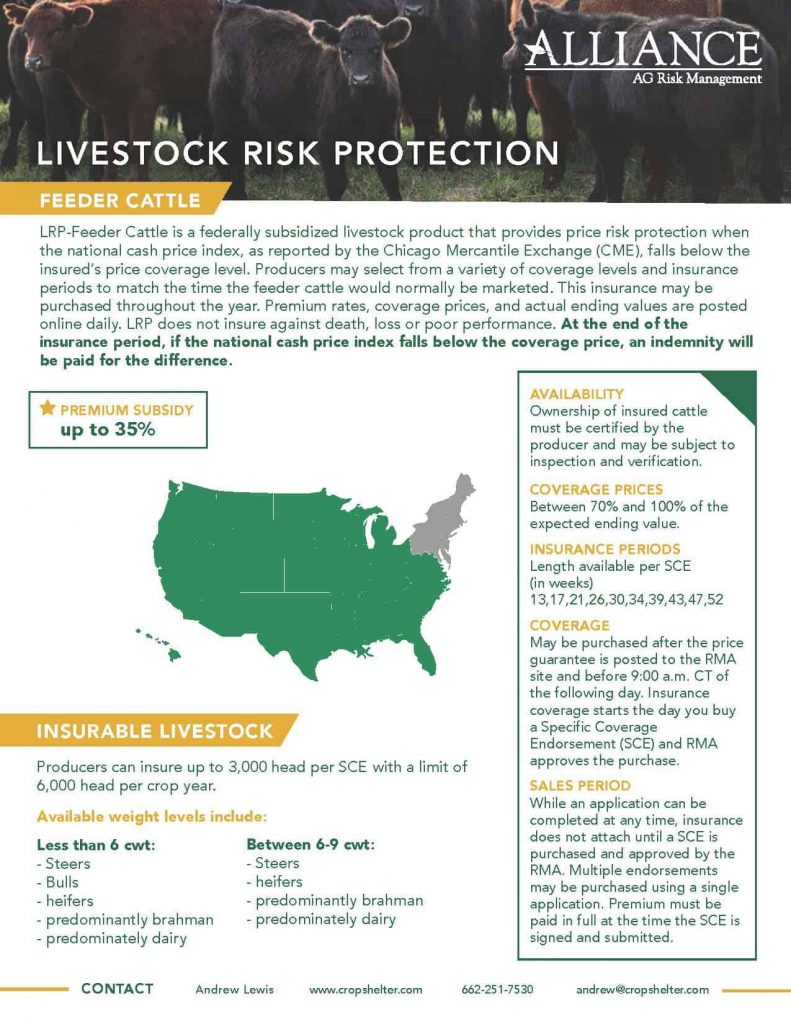

Recognizing Animals Risk Defense (LRP) Insurance policy is important for livestock producers aiming to mitigate economic risks connected with price variations. LRP is a government subsidized insurance policy product developed to protect producers against a decrease in market costs. By providing insurance coverage for market cost decreases, LRP helps producers lock in a flooring rate for their animals, guaranteeing a minimum degree of income regardless of market variations.

One key facet of LRP is its versatility, allowing manufacturers to tailor coverage levels and plan sizes to fit their particular demands. Manufacturers can pick the number of head, weight variety, protection rate, and insurance coverage duration that straighten with their production goals and risk resistance. Comprehending these adjustable alternatives is important for manufacturers to efficiently handle their cost threat exposure.

Additionally, LRP is readily available for different animals kinds, including livestock, swine, and lamb, making it a versatile risk administration device for animals producers across various markets. Bagley Risk Management. By acquainting themselves with the details of LRP, manufacturers can make educated choices to protect their financial investments and guarantee monetary security in the face of market uncertainties

Benefits of LRP Insurance for Livestock Producers

Livestock producers leveraging Livestock Risk Security (LRP) Insurance coverage obtain a critical advantage in securing their financial investments from cost volatility and securing a steady monetary ground in the middle of market uncertainties. By establishing a flooring on the rate of their livestock, producers can mitigate the risk of considerable economic losses in the occasion of market declines.

Furthermore, LRP Insurance offers producers with peace of mind. Overall, the benefits of LRP Insurance policy for animals manufacturers are considerable, using a useful tool for managing risk and ensuring economic protection in an unforeseeable market atmosphere.

How LRP Insurance Mitigates Market Threats

Alleviating market dangers, Livestock Risk Protection (LRP) Insurance provides animals producers with a reputable shield versus cost volatility and financial unpredictabilities. By using protection versus unexpected cost drops, LRP Insurance policy helps manufacturers secure their financial investments and maintain economic stability despite market fluctuations. This kind of insurance enables livestock producers to secure a price for their pets at the start of the policy duration, ensuring a minimal rate level despite market changes.

Steps to Secure Your Livestock Investment With LRP

In the realm of farming danger administration, carrying out Animals Danger Security (LRP) Insurance coverage includes a calculated process to protect investments versus market variations and unpredictabilities. To protect your livestock investment properly with LRP, the very first step is to evaluate the particular risks your procedure deals with, such as cost volatility or unexpected weather occasions. Comprehending these dangers allows you to determine the insurance coverage level needed to safeguard your financial investment properly. Next off, it is crucial to research and choose a credible insurance coverage company that offers LRP plans tailored to your animals and company needs. As soon as you have picked a company, thoroughly assess the policy terms, problems, and protection restrictions to ensure they straighten with your danger monitoring goals. Furthermore, routinely keeping an eye on market trends and readjusting your coverage as needed can aid optimize your protection against prospective losses. By adhering to these actions carefully, you can boost the protection of your livestock investment and navigate market unpredictabilities with self-confidence.

Long-Term Financial Safety With LRP Insurance Policy

Making certain sustaining economic security with the usage of Livestock Risk Defense (LRP) Insurance policy is a sensible long-lasting technique for agricultural manufacturers. By incorporating LRP Insurance coverage into their threat monitoring strategies, farmers can secure their livestock investments versus unanticipated market changes and unfavorable events that can endanger their financial health gradually.

One secret benefit of LRP Insurance policy for long-lasting financial protection is the tranquility of mind it provides. With a reputable insurance coverage in position, farmers can mitigate the economic risks linked with unstable market conditions and unforeseen losses due to variables such as illness episodes or natural calamities - Bagley Risk Management. This stability permits navigate here producers to concentrate on the daily procedures of their livestock organization without continuous bother with possible financial obstacles

Moreover, LRP Insurance policy provides an organized approach to handling threat over the long term. By establishing specific protection degrees and choosing suitable recommendation periods, farmers can tailor their insurance policy plans to line up with their economic objectives and risk resistance, making certain a sustainable and safe future for their livestock procedures. Finally, investing in LRP Insurance policy is an aggressive strategy for agricultural manufacturers to attain lasting financial safety and shield their livelihoods.

Conclusion

To conclude, Animals Threat Defense (LRP) Insurance policy is a valuable tool for livestock producers to reduce market dangers and protect their investments. By comprehending the benefits of LRP insurance coverage and taking actions to execute it, producers can accomplish long-lasting monetary safety and security for their operations. LRP insurance coverage offers a safeguard against price variations and makes certain a degree of stability in an uncertain market setting. It is a wise option for safeguarding animals investments.

Report this page